Want to check your FAB bank balance and transaction history as a customer? Do not worry. We will tell you about 5 best ways to check FAB Bank Balance using the FAB mobile app, bank website, ATM, SMS, or Customer support.

Below, we have collected all of this information so that you can quickly check your FAB scores no matter where you are.

In this blog post, we will discuss using the FAB balance inquiry facility to remain afloat on money matters. We will provide some of the approaches used to access this information, the features and benefits of using it, and its significance.

FAB balance check

FAB bank balance check is an online facility offered by FAB Bank that enables customers to view their account balances and transactional history. It is an easy and handy way to trace inflows and outflows of money from accounts.

The bank balance check service gives customers information about their balance and transactions within the blink of an eye, making managing finances more manageable.

It is helpful for those whose salaries are credited to a bank because they can ensure they have received money using the FAB bank balance check facility.

Methods To FAB Balance Inquiry

Method 1: Using Website

FAB encourages its users to check their FAB balance through the website. Thus, Internet banking by FAB is excellent and reliable for customers to use when managing their bank accounts. Once you key in your username and password on the online banking portal, you can confirm your account balance, view your transaction history, or perform other banking activities.

Step 1: Go to the web: Prepaid Card Inquiry on the Web.

Step 2: Type in the final portion of your card that carries 16 digits.

Step 3: Type the Card ID from your FAB prepaid card below.

Step 4: With this information, go to FAB bank balance check by clicking go.

Method 2: Using Mobile App

At your fingertips is the convenience of banking, offered by the FAB mobile banking app. It works on the iOS and Android platforms. After downloading the app and signing in, you will find that FAB balance checks, transferring funds, paying bills, etc., are easily accessible.

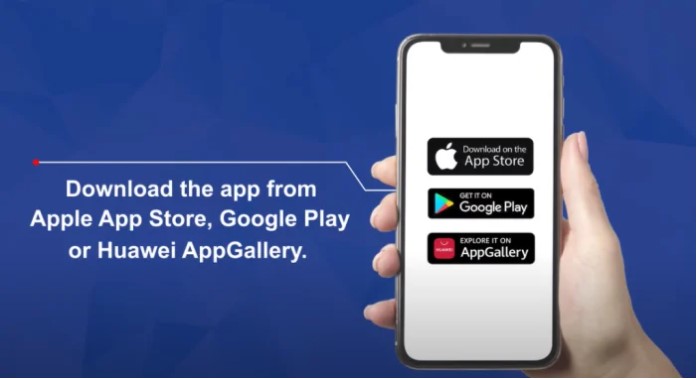

Step 1: Available FAB banking app from Playstore, Apple Store, Hauwei App Gallary

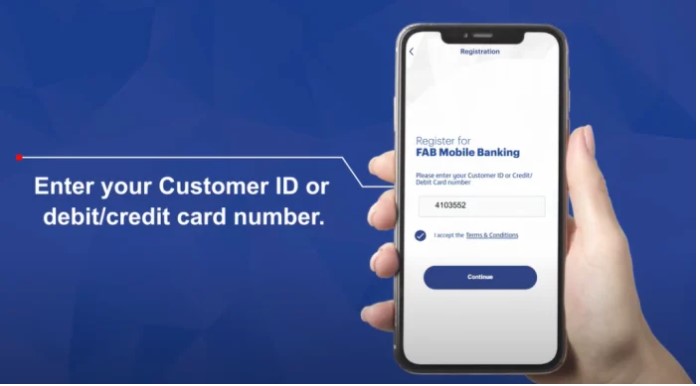

Step 2: Enter your Customer ID or Debit/Credit card number

Step 3: Please provide the one-half password sent to your registered mobile number and email address.

Step 4: Make a PIN of 6- digits

Step 5: Turn on your face ID or switchover

Step 6: After you log in, the balance will be displayed on the app screen.

Method 3: Using ATM

It is possible to check your FAB bank balance through any available FAB ATM in the UAE. To check your current account standings, all you need to do is to input your FAB ATM card, key in the PIN, and then choose the “inquiry” option. You get your account balance on the ATM display screen in a while.

Method 4: Using SMS

In addition, FAB provides SMS banking services concerning an FAB balance check, allowing you to see your account balance by sending one text message.

- All you need to do is send BAL (then write the last four digits of your account number) to 2121.

- Upon your request, you will immediately get an SMS message containing all your account balance information. If you have Internet failure or the ATM is far away, you can check your balances through phone calls.

- To know the current balance in your bank deposit, you need to call 24/7 customer care services for FAB at 600525500.

- Having your identity confirmed by the customer service agent for security purposes, the agent will give you your FAB balance through a phone call.

What is the process for activating the FAB Mobile Banking?

For you to be able to switch on FAB Mobile Banking, you will need a functioning, valid FAB Bank debit card.

Step 1: To get the FAB Bank mobile app, go to your device’s app store to download it. It is accessible on the Apple App Store and the Google Play.

Step 2: You must submit your active debit card details and the OTP number sent by e-mail or SMS to a registered mobile phone or email address.

Step 3: Facing the instructions prompted on the screen, enter a new login password.

After registration, the FAB Bank app allows clients to perform several operations, such as checking a balance, transferring money, and paying bills.

How Much Is FAB’s Minimum Balance?

No minimum balance is necessary to hold in an FAB Bank account. On the contrary, a mandatory minimum balance of 3000 AED must be kept if you have a personal savings account with FAB Bank.

If your account falls below 3000 AED, you will be fined 10 AED monthly.

If you are merely dealing with your deposits and withdrawals in your FAB Bank account, this minimum balance does not matter. This is because, as in this case, your account should be an Elite savings account that doesn’t require you to have any minimum balance.

FAB Swift Code

Society for Worldwide Interbank Financial Telecommunication, short SWIFT, is a global financial institution that provides safe and quality transferring funds.

The code indicates that the transferred money’s destination is the bank branch that has to receive it. In addition, aside from the fact that every bank has its own unique SWIFT code, it is also used for domestic and international money transfers.

Whenever you remit or withdraw monies, you must supply the SWIFT code dedicated to the respective bank branch where your particular transaction will occur.

FAB Customer Care Number

You can ask questions about the services offered through FAB Bank and contact their customer care department. Their contact numbers are 600525500, from where one can reach them, or via their website.

But please note that this number is considered legal only if you live in the UAE. For an international clientele, you can reach them at +971 2 681151.

You can also reach them using social networking sites like Facebook, Twitter, Instagram, and Linkedin. Quickly looking at their website pages will give you their social media profiles.

Benefits of The FAB Balance Check Service

One of the best ways to monitor your bank account for a long time and check your finances is by using the FAB Balance Check service. It enables you to easily see where you stand regarding your balance and, hence, plan accordingly.

Security is also very high, using robust encryption technology to ensure that unauthorized individuals do not access or steal your details. Moreover, the service provides several options for checking your balance, whether through online services or mobile banking.

Any time you want to verify if there has been payroll payment, salary deduction, or successful completion of any transaction, it is an easy task.

In general, the FAB Balance Check service is a cost-effective and secure option to know your balance and ensure that your money is used.

fab bank salary account balance check

Using a salary prepaid card makes it convenient enough to FAB bank salary account balance check. When checking the credit on your prepaid card at any FAB ATM, no numbers must be entered into the password area.

These days, many more people monitor their FAB bank status using the internet from their mobile phones. Employing this method, the task could be completed without difficulties. Remember also that ATMs sometimes may not be available at the front door; thus, online banking is the best.

FAB Cashback Offers

• FAB Cashback Credit Card: The cash-back credit card from FAB has been made to provide you with direct cash back on whatever you have used. In all other retail stores where purchases are made, fuel payments, utility bills, and supermarket purchases, the entire cashback is 5. It is also an intelligent move for expats wishing to save money daily.

• FAB Elite Infinite Credit Card: FAB Elite Infinite Credit Card makes it easy for expatriates to receive a 2% cash refund on all spending, whether within the country or abroad. They can enjoy benefits like multiple-trip travel insurance, access to airport lounges, and concierge services that this card provides. Therefore, it is suitable for constant travelers such as expatriates.

• FAB One Credit Card: This card makes use of an exclusive ‘pick your own cashback’ category, which is a specific brand of cashback program whereby the cardholders get to choose the category that he or she intends to receive most of his or her refund amounts, such as education, dining, or groceries. This is highly advantageous since it allows the expatriate to design his reward program for his life type.

• Traveler Credit Card from FAB: The FAB Traveler Credit Card is designed for those individuals who like traveling and can earn up to 10% cash incentive on buying flight tickets from the travel site. The earned cashback can be used for future travels.

• Offers for FAB Store Cashback: FAB provides cardholders with money-back deals on certain retail shops and online sites through the arrangements made with the different shopping places. These frequently updated variable offers provide expats with a vast array of opportunities why they can make some money on cashback for their purchases.

fab salary check

The acquisition between First Gulf Bank – (FGB) and National Bank of Abu Dhabi – (NBAD) was premeditated to support the firm’s growth.

Using Ratibi, you can charge your workers up to 5,000 organization AED in Ratibi. As a result, the workers will not have to keep a ledger for accumulating their pay.

Retailers and ATMs permit clients to pay without needing a bank balance, with Ratibi Payroll Prepaid Card occurrence giving safety, convenience, and security.

Benefits:

- Free accommodated Mishap Protection

- Access is provided every minute of every day, making ATM and CDM easy to reach.

- The card does not require a foundation equilibrium or monthly payments.

What sorts of equilibrium can be checked in the entryway?

This approach is relevant for clients who are trying to enquire their balance in

- ratibi card compensation check

- nbad ratibi balance check

- ratibi card balance request

- pre-loaded card – enquiry framework.

Stage 1: FAB Bank has a PPC entry that you visit.

Fab Bank has provided free web-based balance check request entry to all cardholders who can assess their Ratibi balance for them.

Stage 2: The Last Digits of Type 2 from Your Ratibi Card Number.

Ensure you carry your Ratibi prepaid card with you. To view your balance, you will need to type a number from your card.

The number will be on the lower left of your pre-loaded card. The value to be entered into the adjacent field is a number.

Ratibi Card Features:

You’ll get an SMS alert for free whenever you are rewarded with the compensation credit.

- Accepting ATMs, retail outlets, and online are 100%.

- Visa/MasterCard companies are global brands.

- Our customer care services are available round the clock, 24 hours daily, seven days a week.

- ATMs browse their own cardholder’s ‘PIN.’

- It is 100% agreeable to the WPS rules of the UAE Government.

You’re covered:

- 1-year free close-to-home mishap protection: if the card owner dies or becomes permanently and totally disabled due to an accident, three times one’s monthly income or a ceiling of AED 25,000 is paid.

- AED 50 a day as hospitalization due to accident (up to 30 days depending upon maximum AED 1,500)

- Come back to the body of mortal remains AED 5,000 maximum.

Helpful and safe:

- Pay your representatives safely with no need to carry money.

- No ledger is important

- A simple, straightforward, and secure installation process

- Moment compensation credit

- 100% computerized

Discover Ratibi’s strengths and make the necessary changes in your business.

- Benefits for managers

- Online card the board of is an ongoing card the management.

- One-touch payment with preloaded cards through online banking on demand.

- Internet Banking Financing can be done on Ratibi pre-loaded cards

Compensation Protection System (WPS)

The Wages Protection System exists where FAB bank can be used to pay wages. The UAE guidelines insist on all forms of compensation payments being handled electronically.

Highlights include:

- It is a dedicated assistance work zone with an entirely automated service.

- A most straightforward and safe approach to paying fees.

- The cost of paying the representatives in local money is low, and there is zero risk of money handling.

Compensation Payment (Non-WPS)

FAB bank also maps the pay scales for Non-WPS payrolls in local currency within the UAE. It allows customers to send check documents in bulk electronically based on one fee entry for their records. Clients could be allowed to view some due content sections.

- Ratibi cards are to be given to the bosses who have Corporate Accounts.

- The business entity shall constitute the resource of workers to the Bank.

- Companies should train their employees on proper card custody methods.

The Bank where the cardholder draws will cancel any seized cards from an ATM, and the business should be required to provide a substitute card.

How To Open FAB Bank Account For Salary Check?

To get the account opened in FAB, you have to follow some rules.

If you are in need of an FAB bank account, there are various types of accounts like salary, savings, and current.

- Go to your closest FAB Bank branch and fill out the necessary application forms by submitting them with relevant documents

- Complete and fill out the online application form on the FAB Bank website.

- Submitting your details to the FAB Bank online platform using the mobile app once you have downloaded it.

- The applicant should call the FAB Bank customer service and request their agent to help in the application process by filling out the form via phone.

Required documents for opening a bank account with any FAB Banks include verifying the mobile number and producing identity and address proofs.

With an open and activated account from FAB bank, you will be issued a debit card, which can be used to enquire about the balance, withdraw money from an ATM machine, or purchase goods online through payment.